Case Study

Automatic Invoice Processing and Tax Validation for Finance Teams

70–90 percent reduction in manual data entry

Processing time shortened from minutes to seconds

Automated VAT and VIES validation to lower tax risk

About the Customer

The client is a mid-sized wholesale distributor serving construction and industrial supply. Their finance team manages several thousand supplier invoices each month, with peaks driven by seasonal purchasing.

Region

Central Europe

Company size

Enterprise

Industry

Finance

Use Cases

Invoice processing

Features

- Data extraction

- Tax validation

- Approval flow

Technologies

- Power Automate

- AI Builder

- Azure OpenAI

- SharePoint

- Excel Online

The client was manually transcribing invoice details from PDFs and paper documents, slowing down month-end work and increasing error risk. ARP Ideas introduced automated data extraction, contractor validation, and structured workflows that significantly accelerated processing and improved compliance.

Challenge

The client needed to eliminate slow manual data transcription and reduce the risk of tax and posting errors without changing their financial system.

Solution

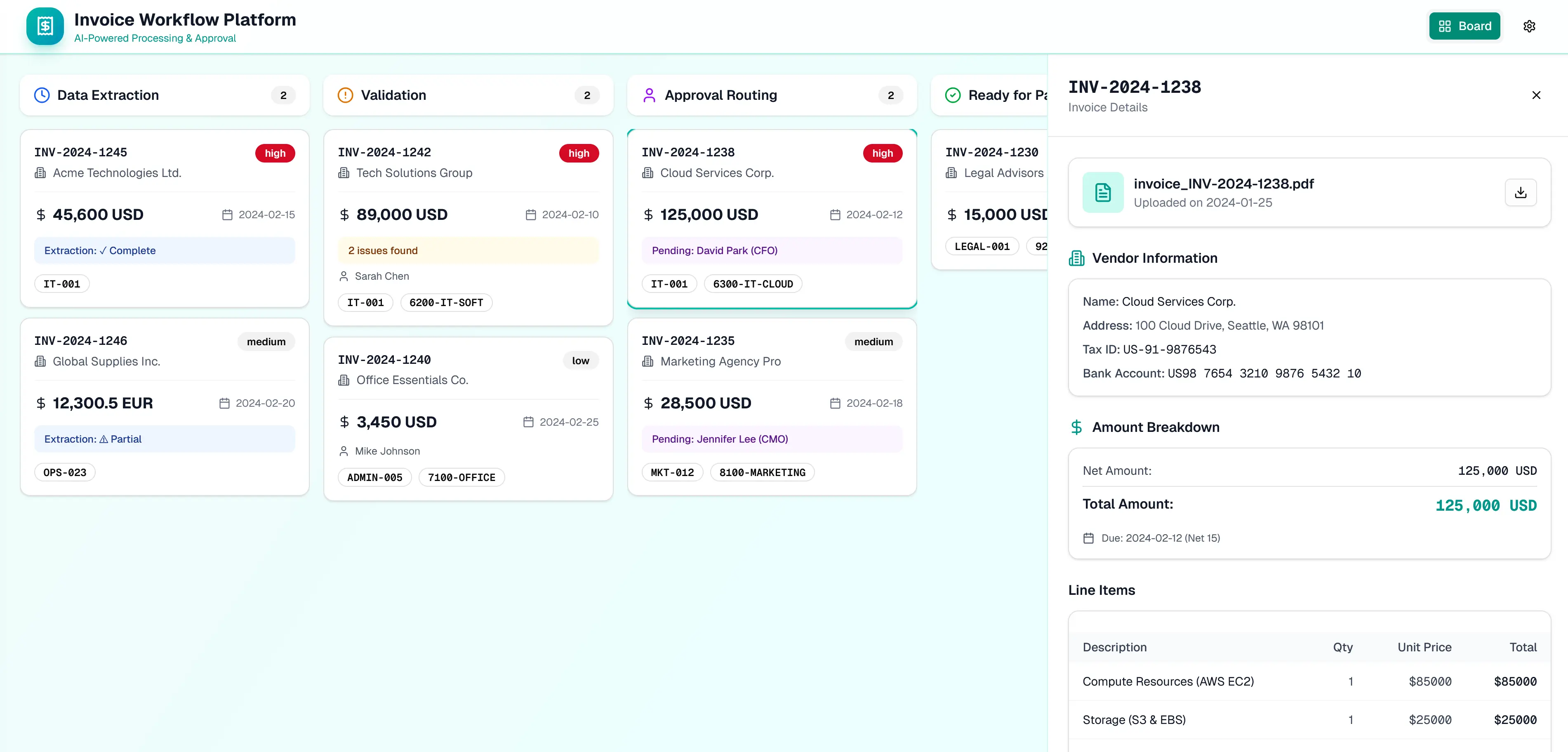

Automated invoice ingestion, AI-based data extraction, structured data output, and contractor tax validation integrated with the existing AP workflow.

Outcomes

The AP team gained significantly faster invoice processing, fewer errors, automated tax checks, and a clear audit trail.

- Faster processing

- Error reduction

- Tax validation

- Audit trail

- Structured data

- Approval workflow

ROI

The automation delivers savings of approximately PLN 20,000 per month for a workload of 3,000 invoices.

Details

The AP department previously relied on fully manual processes to handle cost invoices from suppliers. Staff extracted invoice numbers, dates, VAT identifiers, and amounts by hand from PDFs or paper documents and keyed the information into Excel or the financial system. This approach consumed several minutes per invoice, accumulated work at month end, and increased the likelihood of errors or incomplete contractor verification.

The project aimed to reduce this workload and remove tax compliance risks without requiring the organisation to replace or modify its ERP. Instead, ARP Ideas designed an intelligent processing layer that sits between invoice receipt and accountant approval. Invoices arriving by email, directory upload, or SharePoint were consolidated into a single intake point to eliminate fragmented workflows.

AI technology based on OCR and language models extracted all essential details, including supplier VAT numbers, net and gross values, VAT amounts, and item lines. These outputs were saved in a structured format such as a SharePoint list, Excel file, or via API to the ERP, depending on the client's preferred setup.

Automated checks validated suppliers against the VAT white list and VIES, lowering the risk of posting invoices from noncompliant entities. Each invoice was also assigned a pending approval status, with an option to associate cost centres (MPK) before final posting.

The measurable impact included a reduction of manual effort by 70–90 percent and a decrease in processing time from approximately five minutes to 30–60 seconds of verification per invoice. The client also gained a complete audit path combining the original file, extracted values, and approval decisions.

ROI calculations showed savings of 3.5–4.5 minutes per invoice. For an example volume of 3,000 invoices per month and a labour rate of PLN 100 per hour, this produced an estimated monthly benefit of around PLN 20,000, excluding the additional value of lower tax risk exposure.

If you want to streamline invoice processing, improve compliance, or create a similar intelligent layer around your financial workflows, the ARP Ideas team is here to help. Reach out to explore automation opportunities tailored to your organisation.